Blog

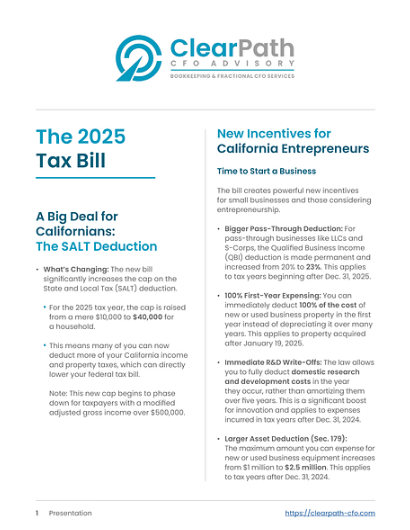

A Big Deal for Californians:

The SALT Deduction

- What’s Changing: The new bill significantly increases the cap on the State and Local Tax (SALT) deduction.

- For the 2025 tax year, the cap is raised from a mere $10,000 to $40,000 for a household.

- This means many of you can now deduct more of your California income and property taxes, which can directly lower your federal tax bill.

Note: This new cap begins to phase down for taxpayers with a modified adjusted gross income over $500,000

New Incentives for California Entrepreneurs

Time to Start a Business

The bill creates powerful new incentives for small businesses and those considering entrepreneurship.

- Bigger Pass-Through Deduction: For pass-through businesses like LLCs and S-Corps, the Qualified Business Income (QBI) deduction is made permanent and increased from 20% to 23%. This applies to tax years beginning after Dec. 31, 2025.

- 100% First-Year Expensing: You can immediately deduct 100% of the cost of new or used business property in the first year instead of depreciating it over many years. This applies to property acquired after January 19, 2025.

- Immediate R&D Write-Offs: The law allows you to fully deduct domestic research and development costs in the year they occur, rather than amortizing them over five years. This is a significant boost for innovation and applies to expenses incurred in tax years after Dec. 31, 2024.

- Larger Asset Deduction (Sec. 179): The maximum amount you can expense for new or used business equipment increases from $1 million to $2.5 million. This applies to tax years after Dec. 31, 2024

Major Savings for Your Home & Health

New Rules for Your Biggest Expenses

- Mortgage Interest Deduction:

- The good news: The new bill makes the current rules for the mortgage interest deduction permanent, preserving a critical tax break for California homeowners.

- The deduction for Private Mortgage Insurance (PMI) premiums has been eliminated. If you pay $3,000 a year in PMI, is no longer a deductible expense. It’s crucial to factor this into your financial planning.

- Health Savings Account (HSA) Expansion:

- HSAs are now more accessible and powerful. They let you save for medical expenses with a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical costs.

Example: A family can now buy a lower premium Bronze or Catastrophic plan through Covered California and still be eligible to contribute to an HSA. By contributing the family maximum (e.g., ~$8,300), they could save over $2,700 in combined federal and state taxes for the year

More Savings for Your Family

Enhanced Tax Credits for Your Family

- Key Updates:

- Child Tax Credit: The credit is increased to $2,200 per child, and the refundable portion will now be adjusted for inflation.

- Adoption Credit: The adoption credit is enhanced, and up to $5,000 of it is now refundable, meaning you can get that

money back even if you don’t owe any federal tax.

Bonus: Telehealth services are now permanently covered before you meet your deductible, making these plans more practical for everyday use.

Why Tax Planning is Crucial for Everyone

Don’t Leave Money on the Table

- Tax laws are complex and constantly changing. Proactive planning ensures you take advantage of every credit and deduction you’re entitled to.

- Without a strategic plan, you risk overpaying the IRS, missing savings opportunities, or facing unexpected tax bills and penalties.