Blog

What Financial Reports Should a Business Have So They Can Manage Their Finances?

To manage finances effectively, every business should regularly prepare and review a core set of financial reports. These reports provide visibility into profitability, cash flow, and overall financial health. Here are the key financial reports your business should have:

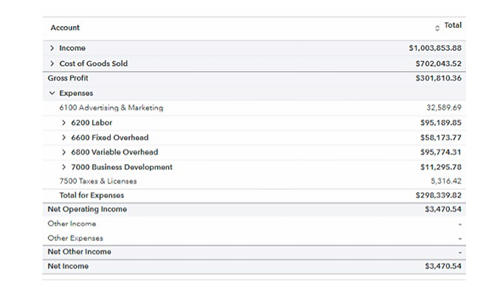

1. Profit & Loss Statement (Income Statement)

Purpose: Shows revenues, costs, and profits over a specific period (monthly, quarterly, yearly).

Use: Measures overall profitability of the business. Helps analyze and identify both revenue and expense trends. Tracks business performance over time. Ultimately, this is used to support strategic decision-making.

2. Balance Sheet

Purpose: Displays assets, liabilities, and owner’s equity at a specific point in time.

Use: Shows what the business owns and owes, helping assess financial stability and solvency.

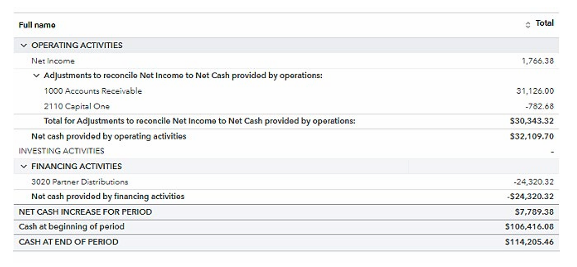

3. Cash Flow Statement

Purpose: Tracks inflows and outflows of cash from operating, investing, and financing activities.

Use: Shows movement of cash from different sources. Used to support business decisions. Helps identify financial risks.

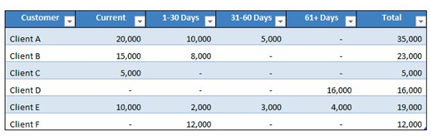

4. Accounts Receivable Aging Report

Purpose: Lists unpaid customer invoices by age.

Use: Helps manage collections and cash flow.

5. Accounts Payable Aging Report

Purpose: Lists what the business owes to vendors by due date.

Use: Supports timely payments and prevents late fees.

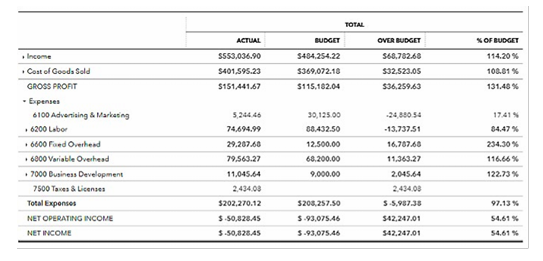

6. Budget vs. Actual Report

Purpose: Compares actual financial results to the business’s budget.

Use: Identifies areas where spending or income deviates from expectations. Overall, used as a guide for objectives and goals.

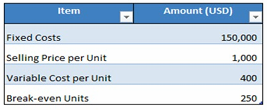

7. Break-Even Analysis

Purpose: Shows the sales volume needed to cover costs.

Use: Identifies the ongoing burn rate and total monthly fixed costs.

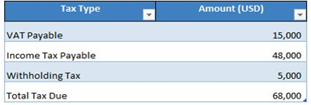

8. Tax Liability Report

Purpose: Outlines both current and projected tax obligations, including sales, payroll, and income taxes.

Use: Ensures compliance and avoids penalties.

Sample Reports (Basic):

Profit & Loss Statement

Balance Sheet

Cash Flow Statement

Accounts Receivable Aging Report

Accounts Payable Aging Report

Budget vs Actual Report

Break-even Analysis

Tax Liability Report

| Report | Use |

| Profit & Loss | Shows revenues, costs, and profits over a specific period |

| Balance Sheet | Displays assets, liabilities, and owner’s equity at a specific point in time |

| Cash Flow Statement | Tracks inflows and outflows of cash from operating, investing, and financing activities |

| Accounts Receivable Aging | Lists unpaid customer invoices by age |

| Accounts Payable Aging | Lists what the business owes to vendors by due date |

| Budget vs Actual | Compares actual financial results to the business’s budget |

| Break-Even Analysis | Shows the sales volume needed to cover costs. |

| Tax Liability Report | Outlines both current and projected tax obligations, including sales, payroll, and income taxes |